The current rate imposed on all consumption of taxable goods and services is 6. Malaysia replaced its Sales and Service Tax regimes with the Goods and Services Tax GST effective 1 April 2015.

Gst And How It Affects The Luxury Goods Industry In Malaysia Bagaddicts Anonymous

In line with the announcement made by the Malaysian Government Goods and Services Tax GST has been implemented with effect from 01 April 2015.

. Implementation will not occur until middle to late 2011 or 2012. The concept behind GST was invented by a French tax official in the 1950s. But when they have been undecided about GST it sparked extra discussion on no matter whether its going to reward the Rakyat.

It will replace the 105 services and goods tax. The earlier taxation structure ie sales and service tax which was 5-15 was reduced to 6 by GST implementation in Malaysia. When will GST be implemented in India.

On goods brought into the country. A tax holiday was declared on 1 June 2018 and the GST rates were reduced from 6 to 0 which was the beginning of the transition. GST is an abolished value-added tax in Malaysia.

But when they were undecided about GST it sparked more conversation on whether itll benefit the Rakyat or further threaten. There were many responses when the Malaysian government first announced the Financial Budget for Malaysia year 2010 both good and bad. GST rates are promised at 4 out of the normal 10 or 5 charged in restaurants.

GST Implementation in Malaysia The Argument. Goods and Services Tax GST was implemented on 1 April 2015 at a standard rate of 6. In Malaysia the GST has a broad base and is imposed on about 40000 goods and services.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input. Malaysia may look at a possible implementation of the Goods and Services Tax GST in the medium term likely by 2022 or 2023 to help correct the governments fiscal position and. Here are some of the tax rates of countries around the world who have implemented GST or VAT.

Roughly 90 percent of the worlds population live in countries with VAT or GST. In Malaysia our tax system involves several different indirect taxes. Lessons from Australias GST Implementation for Considering the US.

Here are some of the tax rates of countries around the world who have implemented GST or VAT. This means taxes are lower now Consumers need not pay more for one area but its divided into many other source of tax payments. There were being quite a few responses when the Malaysian government to start with declared the Financial Funds for Malaysia yr 2010 both equally fantastic and bad.

The implementation of GST system that has two rates of GST 6 and 0 and provides for the zero-rating of exported goods international services basic food items and many booksAs a broad based tax GST is a consumption tax applied at each stage. In Malaysia our tax system involves several different indirect taxes. Goods and Service Tax in Malaysia is a single taxation system in the economy levied on all goods and services in the country.

GST is not new. However three years later in May Malaysias Ministry of Finance announced that GST would be abolished and replaced by SST. On goods brought into the country.

GST Implementation in Malaysia The Argument. The previous service tax is no longer applicable to tax invoices issued on and after 01 April 2015. GST was scheduled to be implemented by the government during the third quarter of 2011 but the implementation was delayed until 1 April 2015.

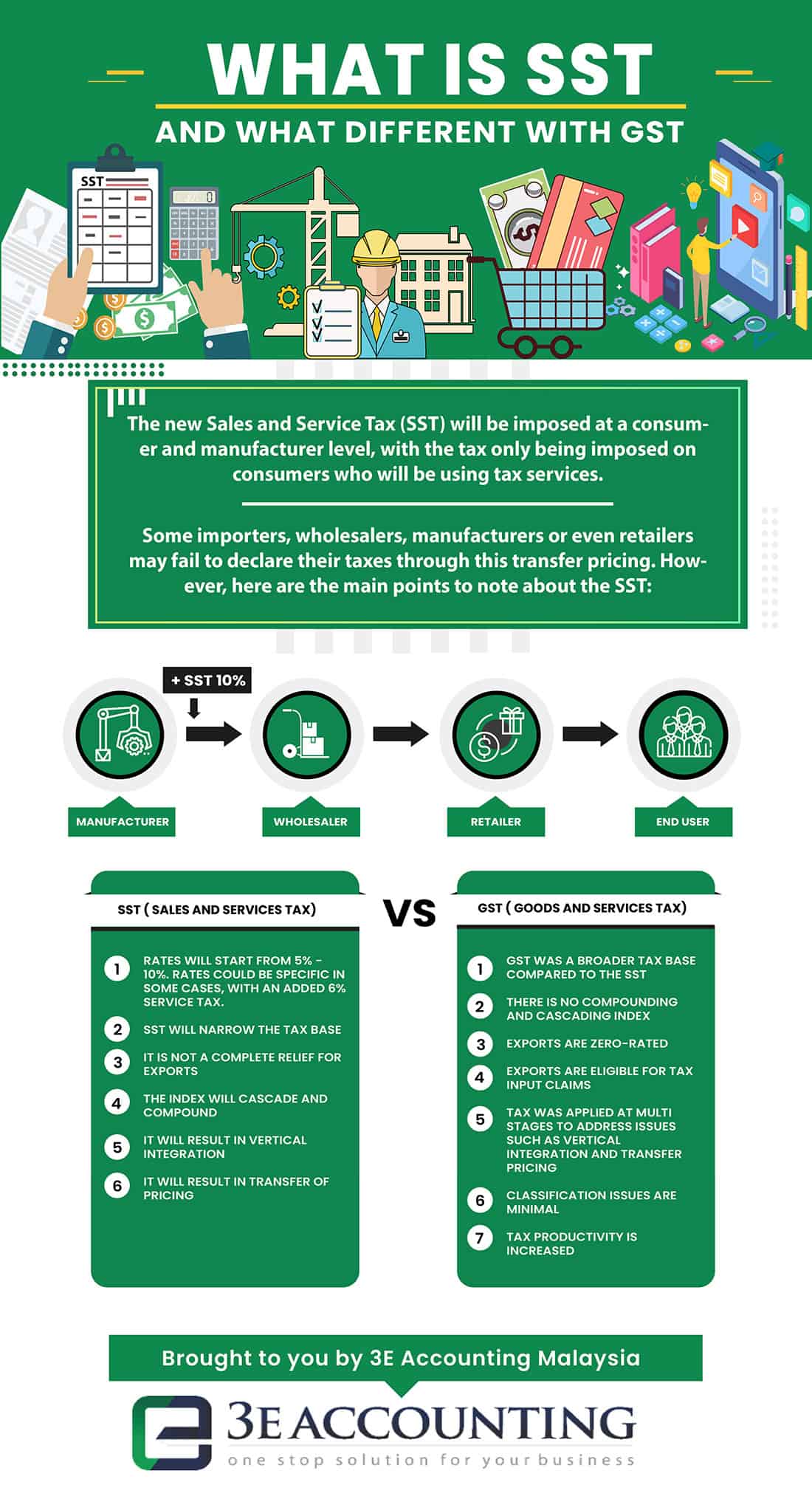

All the goods and services offered in the country would be charged at 6 tax. However the SST has a narrow base and only captures about 40 of the locally manufactured and imported goods.

A Guide To Gst In Malaysia How Does It Affect Me

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Gst Vs Sst In Malaysia Mypf My

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Speeda Malaysia S Gst Effect Catalyst Or Deterrent Speeda

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Gst Better Than Sst Say Experts

Goods And Services Tax Malaysia Gst Ts Dr Mohd Nur Asmawisham Bin Alel

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

A Guide To Gst In Malaysia How Does It Affect Me

1 Gst Charge At Each Level Of Supply Chain Source Royal Malaysian Download Scientific Diagram

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

An Introduction To Malaysian Gst Asean Business News

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

- kata kata bijak dari anak band

- peraturan dalam futsal

- kata bijak untuk penghianat

- cara menghitung berat besi beton polos

- labour law for foreign worker in malaysia

- cpg heart failure 2019

- datuk seri mohamed azmin ali

- undefined

- when was gst implemented in malaysia

- handbag online malaysia murah

- 2019 public holidays malaysia

- management trainee malaysia airlines

- dekorasi kamar tidur ruko

- ikan bilis kartun

- e-penyata pencen

- kata kata ucapan selamat siang buat pacar bahasa inggris

- desain rumah hook modern

- nama anak lelaki zafran

- lukisan tulang daun

- fotorex holdings sdn bhd